ARATOR Holdings is a privately held investment company with a diversified portfolio across multiple asset classes in both public and private markets. Guided by a disciplined investment strategy, ARATOR leverages deep sector expertise, strategic partnerships, and market intelligence to identify high-potential opportunities and generate sustainable value.

-

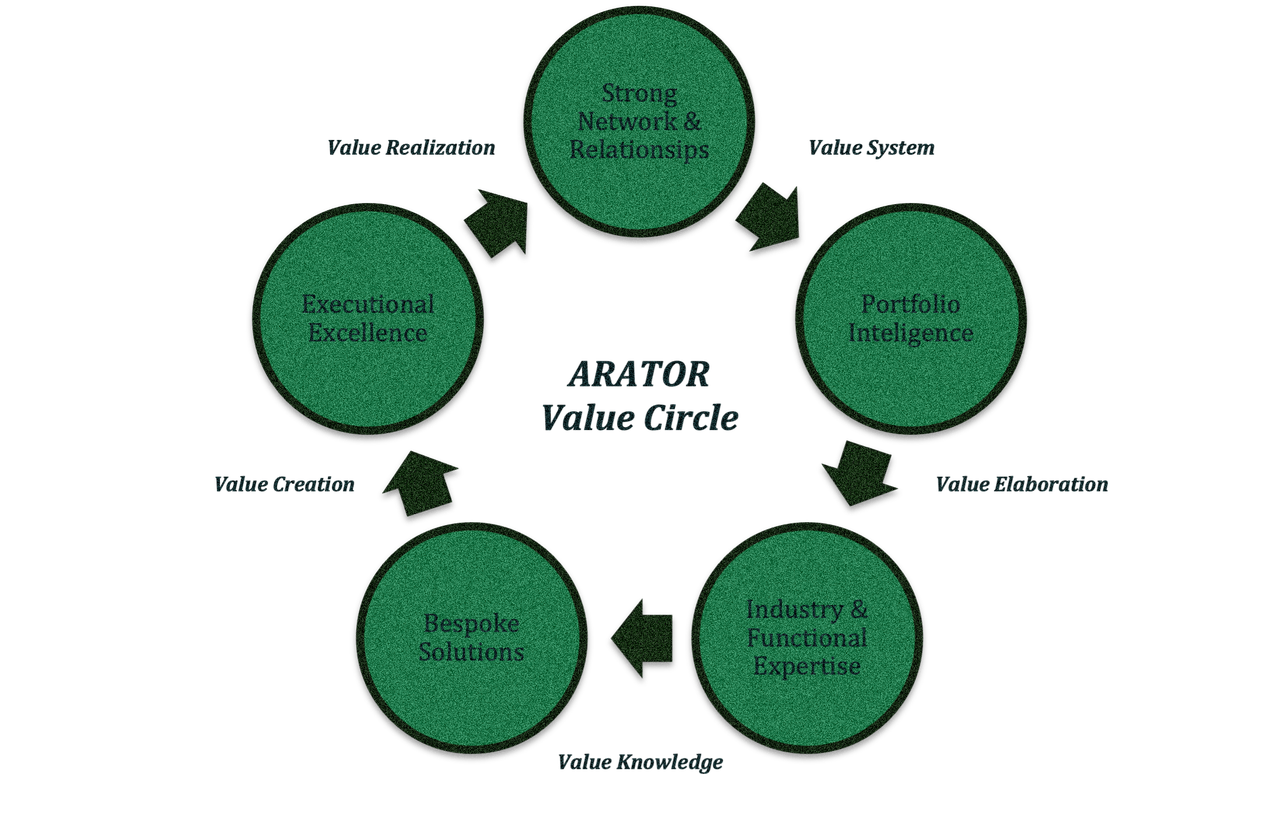

At ARATOR, value creation drives everything we do. We combine deep industry knowledge, strong partnerships, and hands-on experience to solve complex business challenges and improve performance.

Through tailored strategies, not one-size-fits-all approaches, we help businesses grow, create lasting impact, and build long-term success.

-

At ARATOR, we invest in privately held companies that are often overlooked or undervalued, yet possess hidden strengths and management teams ready for transformation. Our investment model combines capital, strategic thinking, and hands-on operational support to enhance performance and create long-term value.

Invest

We target undervalued companies with solid business models and untapped potential. Leveraging our expertise, we identify opportunities where the market fails to recognize true worth.Value Creation

We actively support businesses in driving growth through:- Strategy – Redefining business models and unlocking new growth opportunities.

- Operations – Strengthening execution, organizational structure, and efficiency.

- Capital – Optimizing financial resources to support growth and mitigate risk.

- Communication – Building strong brands and investor confidence.

We work side by side with management teams to implement meaningful and lasting change.

Exit

From day one, we plan with a successful exit in mind. Throughout our co-ownership, we keep the business exit-ready, monitor market conditions, and ensure all elements are in place to secure the best possible outcome at the right time. -

At ARATOR, we drive excellence with integrity and focus to deliver sustainable returns.

Core Values

- Excellence – Highest standards in strategy, execution, and governance.

- Sustainability – Investments that drive lasting growth.

- Entrepreneurship – Creative thinking and challenging the status quo.

- Integrity – Transparency, ethics, and accountability.

- Collaboration – One team, across functions and markets.